Sales tax calculator convert it

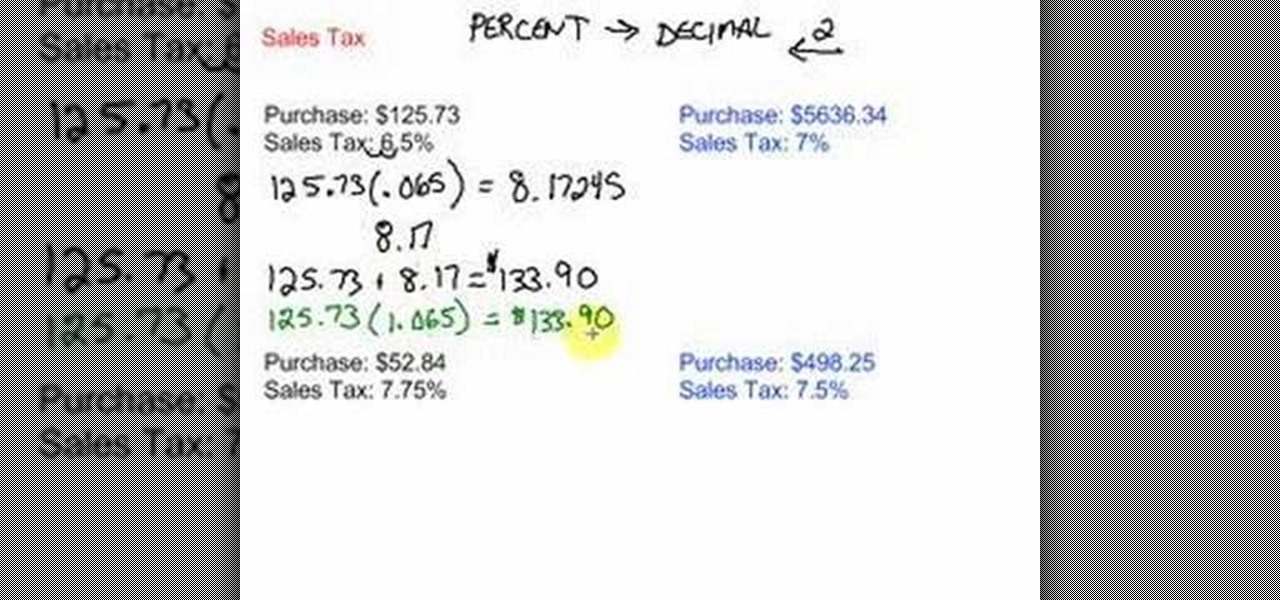

Calculate the amount of sales tax and total purchase amount given the price of an item and the sales tax rate percentage. Then multiply the resulting number by the list price of an item to figure out the sales tax on that item.

Salary To Hourly Calculator

Can we convert Dollars into Basis Points.

. Hourly weekly biweekly semi-monthly monthly quarterly and annually. OP with sales tax OP tax rate in decimal form 1. The state will request all the sales support for that period including sales tax exemption certificates.

What is the impact of increasing my 401k contribution. The bps calculator can be a good way to find the values. Converting a number in Scientific Notation to Decimal Notation.

If you know the listed price and the after-tax cost this calculator will help you find the sales tax rate. Then divide the tax rate by 100 to convert it to a decimal. This free weight converter allows you to quickly convert between kilograms grams pounds ounces stones and other imperial and metric weight units.

Wondering what sales tax rate was charged on your item. So lets say youre buying something that costs 2795 with a local tax rate of 8. Enter the number of hours you work a week and click on Convert Wage.

Enter Sales Tax. To do this multiply the tax rate value youve acquired by 100 to get a percentage value. More specifically the customers have more time after receiving the product to actually pay for it.

Sales tax revenue is only second to individual state income taxes which. To find the original price of an item you need this formula. How to Calculate Days Sales Outstanding DSO The accounts receivable AR line item on the balance sheet represents the amount of cash owed to a company for productsservices earned ie delivered under accrual accounting standards but paid for using credit.

For the 2021 fiscal year sales taxes accounted for about 30 of states revenue according to the Tax Foundation. For example if the sales tax rate is 8 the decimal figure will be 08. This calculator estimates the average tax rate as the state income tax liability divided by the total gross income.

Start converting square feet to square meters. During a state sales tax audit the company and the state agree to a sample period in order to test if sales tax was properly calculated on the revenue of the company. Once you know the tax rate in your area convert the sales tax rate from a percent to a decimal by moving the decimal point two places to the left.

What may my 401k be worth. 8 sales tax rate 100 008 Multiply the listed price of the item by the sales. Take the percent number and imagine a decimal point after it.

First enter the dollar amount of the wage you wish to convert as well as the period of time that the wage represents. We multiply 64 by ten 7 times. Add 100 percent to the sales tax rate.

Convert my hourly wage to an equivalent annual salary. What is the future value of my employee stock options. Enter the value you want to convert.

Handbook of Mathematical Functions AMS55 Conversion Calculation Home Calculators Financial. The 100 percent represents the whole entire pre-tax price of the item in question. We can sell our stock option for 150000 so 100 bps is 150 for our given values.

Select the weight units. The INR function converts a number to the Indian Style Comma formatted currency as you can see in the snapshotThe commas are placed in the right places separating lakhs and crores. We need to divide the sale value by 100 to find 100 basis points.

Wondering how to convert square feet to square meters. What may my 457b be worth. So you cannot directly use the result in.

But the result that you get is in the Text Format. Should I exercise my in-the-money stock options. Write the number 64 10 7 in decimal notation.

So if the sales tax in. Convert my salary to an equivalent hourly wage. 64 10 7 means 6410101010101010.

The decimal point is moved 7 places to the right. Convert the sales tax percentage into a decimal figure. How to use the converter.

Some calculators may use taxable income when calculating the average tax rate. The sample period can be one month quarter or year. Convert the tax rate into a percentage value.

When you add it to the tax rate you get a total percentage that represents the pre-tax price plus the tax. Now move that decimal point two spaces to the left giving you the decimal equivalent of the sales tax percentage. Instead of using the reverse sales tax calculator you can compute this manually.

This calculator can convert a stated wage into the following common periodic terms. Take the work out of calculating the conversion and simple enter in the number of square into the calculator and instantly see calculated result in square meters.

Gst Calculator How To Find Out Goods And Service Tax Tax Refund

How To Calculate Sales Tax In Excel

Percent Off Calculator Percents Calculator Finance

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Sales Tax Calculator Taxjar

Reverse Sales Tax Calculator

How To Figure Out And Calculate Sales Tax Math Wonderhowto

Web Based Sales Tax Calculator Organizing Paperwork Business Emails Web Based

How To Calculate Sales Tax In Excel

Sales Tax Calculator

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Sales Tax Calculator Apps On Google Play

Reverse Sales Tax Calculator Calculator Academy

How To Calculate Sales Tax In Excel Tutorial Youtube

How To Calculate Sales Tax In Excel

How To Figure Out And Calculate Sales Tax Math Wonderhowto

Sales Tax Calculator Price Before Tax After Tax More